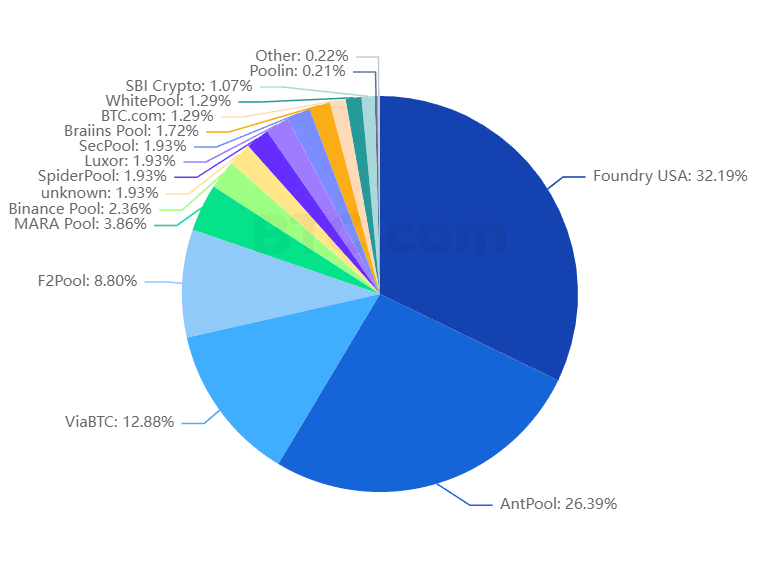

There’s a growing concern in the crypto community that Bitcoin is becoming too centralized, which could undermine its core principles. Recent data shows that two mining pools, Foundry USA and AntPool, now control about 57% of Bitcoin’s total mining power.

Foundry and AntPool Dominate Bitcoin Mining Pools

Bitcoin mining pools are groups where individual miners team up, combining their computing power to increase the chances of successfully mining a block. After deducting maintenance fees, the rewards are shared among the participants based on how much power they contributed.

These pools have grown in popularity because they offer a more consistent income than solo mining, which can be unpredictable. However, the mining landscape is now dominated by two major players, Foundry and AntPool, who are fierce competitors. According to data from BTC.com, the total Bitcoin network hashrate is about 651 EH/s, with Foundry contributing 215.79 EH/s and AntPool 153.55 EH/s.

Some experts are warning that the competition between Foundry and AntPool could have geopolitical consequences. Foundry USA, owned by Digital Currency Group (which also owns Grayscale), aligns with U.S. interests, while AntPool, run by China’s Bitmain Technologies, represents Chinese influence.

As Bitcoin mining becomes more centralized, concerns are growing about the future of the cryptocurrency. Bitcoin developer Luke Dashjr has previously highlighted the dangers of large mining pools, arguing that centralization could threaten Bitcoin’s decentralized nature and lead to issues like censorship and control.

If a single mining pool were to control more than 50% of the network’s hash rate, it could potentially launch a 51% attack, which would undermine the network’s integrity. While no single pool has reached that level of control yet, the concentration of power among a few pools has already resulted in instances of transaction censorship on the Bitcoin network.

GFCgVt Bgit CjoUET bfpv AJgqY slhXT aCQquZa